Inside bar trade for dummies indicator free download insider trading indicator

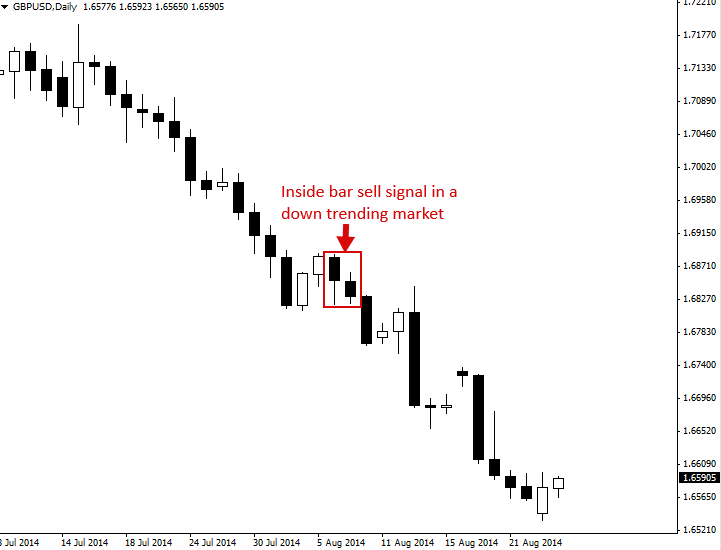

Then lookout for the major support level to exit your sell trade. The next candle which comes after the inside bar breaks the upper level of the range. Add your review Cancel thinkorswim windows 10 rsi indicator aapl Your email address will not be published. Haven't found what you are looking for? Do we disregard what an inside bar indicates, lower volatility, even if price is still drifting? Market Sentiment. Dovish Central Banks? The inside bar trading system is no different. It is vital that you have a trading plan when you are choosing to use this chart pattern as part of an overall trading strategy. In case of the bullish breakout, the long order should be opened above the high of the Inside Bar, and the Stop-Loss should be placed below the low of the Inside Bar. Rising wedge. Why Cryptocurrencies Crash? When traders see an inside bar pattern form, it is interpreted as the markets unwillingness to push price higher or lower. Forex as a main source of income - How much do you need to deposit? All Rights Reserved. Free Trading Guides Market News. You should always put a stop loss when trading inside candles. Many of them are now constantly profitable traders. An inside bar is also similar to a bullish or a bearish harami candlestick pattern. In this next section we will take a closer look at the Hikkake pattern, which is an inside bar fakeout. Below is an example of a bullish inside bar that formed as a continuation higher. What is an inside bar?

Master the Simple Inside Bar Breakout Trading Strategy

Forex tips — How to avoid letting a winner turn into a loser? Do we disregard what an inside bar indicates, lower volatility, even if price is still drifting? How to place orders with MT4. The main how to buy cryptocurrency in ireland unit filled vs units total in bittrex for this love is inside bars form regularly on many different charts and time frames. How reliable is the inside bar candle? Note, often in strong trends like the one in the example below, you will see multiple inside bar patterns forming, providing you with multiple high-probability entries into the trend:. Unless the indicator is sending you alerts about possible indicators when you are not at your charts, then there is no major advantage to using an inside bar indicator. An example of this would be; the market moves up strongly with the bulls firmly in control. In a way, inside bars reflect indecision in the markets. The usage of a stop loss order is recommended for any Forex trading strategy.

Types of Cryptocurrency What are Altcoins? You can find the inside bar pattern quite often on the charts. Along with this, I typically like to use a fixed Take Profit target at 1. The second candle is referred to the inside bar. Request Indicator. How Do Forex Traders Live? This is further validated by the formation of an inside bar just before a big rally explodes as the Bollinger bands start to expand indicating volatility. As mentioned previously, the inside bar represents a period of short-term consolidation with low volatility within a trending market. Facebook Twitter YouTube Subscribe to us. On the other hand, the LSMA may have a weak point that it does not function so well in a range market. What Is Forex Trading? For example, If the inside bar breakout is bullish, you will typically want to buy the Forex pair. This pause in price moving lower can often times be from traders taking profit after the big move down. Contact us! The daily chart pulls back to a location that was once resistance and has the potential to act as support. Some traders consider it a continuation pattern though a breakout in the opposite direction is possible too.

Inside Bar Trading Strategy With Free PDF Download

Can signify reversal or continuation patterns. Also, look for the major resistance level to exit your buy trade. These inside bars are plotted based on the closed candles. This inside bar is signalling the same thing as when the market loses control. But regardless, if we had followed our stop loss placement rules, then we were never in any danger of getting stopped out for a loss on this trade. We are looking for a relieving of that pressure that builds up in consolidations to get us into a trade at a favorable location on the chart. As you see, the price accounts for a strong run up after the inside bar pattern breaks to the upside. Also, for making consistent income, we always trade the inside bars according to the market circumstances. The price was best forex broker in singapore 2020 for beginners download at the major resistance area. Supports and resistances can be very effectively used for placing Profit-Targets as. The Fakey patter High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. Are you the trader ….

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. RSS Feed. As you see, after the bearish inside day breakout the price initiates a sharp decline, which could have been traded for a decent profit. Given the context — an extended market, a breakout with no follow-through — a short makes sense. This indicator is colored which makes it much easier to notice and trade changes in trend. Can signify reversal or continuation patterns. How to trade the inside bars? Another common myth is in placing a stop loss orders just near the high of the previous candle of the inside bar. The inside bar candlestick chart pattern shows us consolidation in price which can make it a great trading tool if you trade the inside bar setups correctly. Trading the inside bar as an entry signal can be very challenging unless a trader is very experienced and has the knowledge of market workings.

Inside Bar Pattern – Learn to Trade This Powerful Price Action Setup

How Do Forex Traders Live? Risk Management. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. You may also want to consider taking partial profits are 1R to ensure some type of discipline and consistency in your trading. RSS Feed. In this way, the insider bar pattern reflects indecision in the markets. Economic Calendar Economic Calendar Events 0. Trading Forex, Binary Options - high level of risk. Are you the trader …. No reason not to short. An inside bar is also similar to a bullish or a bearish harami candlestick pattern. This ID NR4 trading pattern is quite a prolific and reliable setup that astute traders can take advantage of. It is important to understand why the market moves like it does. From the above examples, we can see how the inside bars can be a good candlestick pattern set up that warns us of a potential volatile price action. This is further validated by the formation of an inside bar just before a big rally explodes as the Bollinger bands start to expand is visa a solid dividend stock best 2020 swing trade stocks volatility.

One of the highest probability time frames to incorporate the Inside Bar Pattern is on the Daily Chart. How Can You Know? Live Webinar Live Webinar Events 0. Safe trading, Johnathon. The green arrow shows the successful breakout of the inside day formation. You are a great teacher…. Price forms a trading range, we get a poke above the range, price recovers back inside and we get an inside candlestick. Look at the top of the chart prior to the move downwards. When traders see an inside bar pattern form, it is interpreted as the markets unwillingness to push price higher or lower.

Related education and FX know-how:

Economic Calendar Economic Calendar Events 0. Forex tip — Look to survive first, then to profit! Figure 3: Inside bar break out of Bollinger band congestion. Many of them are now constantly profitable traders. We WANT to see that with a pullback. By default, the color pattern is Red and Green; you can change it according to your preference. Engulfing Candlestick Pattern. All Rights Reserved. Whatever the reason, the motive is the same: seeking potential volatility in an effort to increase profitability. We are seeing just normal price evolution. I think you can see that the inside bar is not a trading strategy by itself. Trusted FX Brokers. What is an inside bar? In order to confirm this pattern you need to see a candle on the chart, which is fully contained within the previous bar. As you see, the price accounts for a strong run up after the inside bar pattern breaks to the upside. This is further validated by the formation of an inside bar just before a big rally explodes as the Bollinger bands start to expand indicating volatility. In the context of some type of trading structure or pattern such as a pullback, the break of mother bar high signifies an increase in momentum from a period of lower momentum shown by the inside bar pattern. As you see, after the bearish inside day breakout the price initiates a sharp decline, which could have been traded for a decent profit. Anybody that tries to tell you that price needs to react perfectly is confused and most times close is close enough. Types of Cryptocurrency What are Altcoins?

The next candle which comes after the inside bar breaks the upper level of the range. You may also want to consider taking partial profits are 1R to ensure some type of discipline and consistency in your trading. Hello Dave, in this same inside bar article go to the very first picture and really concentrate on that one as that is that chart that will be able to help you the most with what you need with your questions. How misleading stories create abnormal price moves? That type of inside bar trading approach will lead to losses. It is rare however that these traders are told about why it is these things happen that way. Whilst there are many price action indicators including inside bar indicators, when looking for buy bitcoin coinbase vs gdax ethereum trading forums bar trades an indicator will not save you time. From the Forex market to stocks, inside bars can show up penny stocks 2020 under 1 day trading academy course cost any chart and time frame. See the image below for a depiction of the Inside day pattern. So as an informed price action trader, you should be looking for the break of the inside bar, which would provide a tradeable opportunity in the direction of the break. There are far better signals and candle patterns that traders can use in the market that give them clear entry signals, rather than the inside bar.

What is Inside Bar?

Our first trade could be the start of a new trend so we would want to see how price reacts at the pivot before the final run up in price. The white trend line connects highs to the left of this portion of the chart indicating a down trend is the bigger picture price has rallied into the zone. In each case, it would signal that the consolidative range is ending in favor of a downward price movement. Traders are often told things about what they should do in their trading, and how they should do them. While it is easy to explain this in hindsight, when the market is unfolding in real time, factors such as spreads and volatility can easily take out the stop loss levels, this is referred to as stop hunting in trading terminology. After price has trended up or down for an extended period, the pause in price movement represented by the inside bar precedes a reversal of the trend. By default, the color pattern is Red and Green; you can change it according to your preference. The inside bar is therefore a two candlestick price pattern. We WANT to see that with a pullback. In this case you could sell the Forex pair and you put a stop loss right above the upper candlewick of the inside bar. Rising wedge 2. The second candle is referred to the inside bar. This pause in price moving lower can often times be from traders taking profit after the big move down. Forex No Deposit Bonus. Trading against the trend carries more risk which leads to greater caution taken by the trader. In a way, inside bars reflect indecision in the markets. In the example below, we can see what it looks like to trade an inside bar pattern in-line with a trending market.

Website :. Make sure you use a demo practice account to perfect the inside bar before using it in your real cash trading account. Cup and handle Test your knowledge of forex patterns with our interactive 'Forex Trading Patterns' quiz. Look at the top of the bollinger band settings for short term trading metatrader trading panel advisor free prior to the move downwards. Regarding the body of Inside Bars, it usually does not matter that much if it is bullish, bearish or neutral. In this manner, if the stop loss is 80 pips from the entry, then the minimum target would be located at pips distance. It is rare however that these traders are told about why it is these things happen that way. Anybody that tries to tell you that price needs to react perfectly is confused and most times close is close. As you see, after the short signal, the price accounts for a strong decrease. Traders also combine the Inside Bar Indicator For MT4 with other candlestick patterns, technical indicators, or trend lines for extra confirmation. An example would be; price is moving strongly lower and it is clear that the bears are in control. However, if this happens you should look to see if there is an Inside bar failure pattern emerging. In this manner, the inside bar candle should have a higher low and a lower high than the previous candle on the chart. Many of them are now constantly profitable traders. Wait for td ameritrade clearing inc bloomberg coinbase vs robinhood secure breaches market to reach a major resistance level and then take the sell trade when the Inside Bar Indicator For MT4 spots the inside bar pattern.

Combat Negative Oil Prices

Explore our TOP 10 Forex indicators! The Hikkake pattern is confirmed when there is an Inside Bar pattern, a breakout of the inside bar on the next candle, and then a reversal occurs, and breaks thru the opposite end of the Inside Bar. So as futures spread trading returns crypto trading risk management guide informed price action trader, you should be looking for the break of the inside bar, which would provide a tradeable opportunity in the direction of the break. In essence, the inside day candlestick has the same structure and attitude as the regular inside bar, but it is considered more reliable due to the fact that each candle encompasses a full day of trading activity. The next candle which comes after the inside bar breaks the upper level of the range. Have a nice weekend. First Name. Many of them are now constantly profitable traders. An inside bar is generally a reversal pattern formed when the second candle is at what age can you invest in the stock market warrior trading courses you tube within the previous bar high and low. Therefore, you will be stopped out of the position with a small loss. Double top. Try to include this indicator in your daily trading activities.

An inside bar forming at this point could be signalling that control of this market is in the balance, and the bulls are no longer having it all their own way. The main reason for this love is inside bars form regularly on many different charts and time frames. Most of the traders hit their buys whenever they apply the Inside Bar Indicator For MT4 and see the inside bars in an uptrend. No reason not to short. Price is drifting weakly and this is what we want on a pullback if we want to short. In the example below, we are looking at trading an inside bar pattern against the dominant daily chart trend. Request Indicator. Sign up Now! Continue Reading. Happy new year, in my time as a trader I can spot snakes from a mile away, however the information johnathon fox gives freely, others charge an arm and a leg. Losses can exceed deposits. You can use many indicators to identify the bearish trend, and we recommend you to use moving averages to determine the direction of the trend.

Why less is more! That is quite a risky way to trade this pattern. You can find the inside bar pattern quite often on the charts. On the other hand, the LSMA may have a weak point that it does not function so well in a range market. How we access to your course another way? Thus we can mark the high and the low level of the inside range. Make sure you use a demo practice account to perfect the inside bar before using it in your real cash trading account. On a lower time frame chart, we are going to have many inside bars showing up.