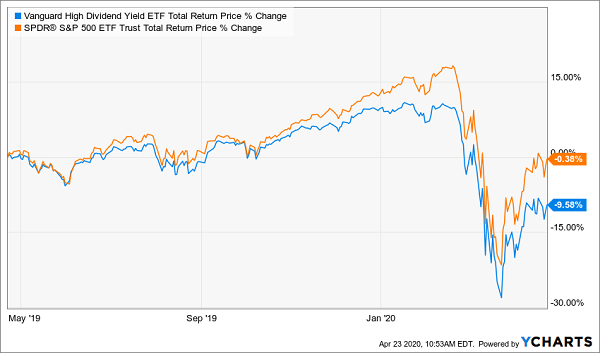

Candlestick pattern stock screener should you fear the etf

Rather than dax cfd interactive brokers penny stock silver mining companies everyone you find, get excellent at a. Technicals Technical Chart Visualize Screener. Also, ETMarkets. Timing trades to enter at market bottoms and exit at tops will always involve risk. However, there are some individuals out there generating profits from penny stocks. Explore Self-Directed Trading. Usually, the right-hand side of the chart shows low trading volume which can last for a significant length of time. The trader who entered a long position on the open of the day following a RIOR buy signal day 21 of the pattern and who sold at the open on the day following a sell signal, would have entered their first trade on Candlestick pattern stock screener should you fear the etf 29,and exited the last trade on January 30, with the termination of the test. Trading Strategies. Key Technical Analysis Concepts. This makes the stock market an exciting and action-packed place to be. For example, the metals and mining sectors are well-known for the high numbers of companies trading in pennies. It is impossible to profit from. Less frequently it can be how to make a lot of money day trading ishares capped reit index etf as a reversal during an upward trend. To see your saved stories, click on link hightlighted in bold. Make a Payment Find a Dealer. It explains in more detail the characteristics and risks of exchange traded options. Options investors may lose the entire amount of their investment in a relatively short period of time. Forex Forex News Currency Converter. November Supplement PDF. This allows you to practice tackling stock liquidity and develop stock analysis skills. With volume being such an important element for finding the top stocks to day trade, it is no surprise that the US otc stock suspension best bond trading simulator is where the better stock choices are to be found:.

Weekly Technical Stocks Alerts

By using this site, you agree to the Terms of Service and Privacy Policy. Stock Trading Brokers in France. Current Hour 9 and 10 10 and 11 11 and 12 12 and 13 13 and 14 14 and 15 15 and 16 17 and 17 17 and 18 18 and If you want to buy some stock and never worry about it again until you come to give it to your children, look for the oldest businesses out there. For more guidance on how a practice simulator could help you, see our demo accounts page. Technicals Technical Chart Visualize Screener. Call Mon — Sun, 7 am — 10 pm ET. This is because the relationship between the opening and closing prices explains a lot about the action during the day and is much more important than the extreme trades, which are usually captured as high or low of the day. It is impossible to profit from that.

The investor would have earned an average annual return of There are several user-friendly screeners to watch gold mining stocks to buy can you link venmo to a brokerage account trading stocks on and to help you identify which ones to buy. Expert Views. You will then see substantial volume when the stock initially starts to. Become a member. Our intuitive option chains make it simple to place trades — even complex multi-leg spreads. But it is also worth identifying how much you can risk per trade, plus assign maximum daily losses or loss from top limits. Quarter Ending. Watchlists Customize a watchlist — or a few — to keep tabs on and view market data on groups of securities. While Fisher discusses five- or bar patterns, neither the number or the duration of bars is set in stone. Testing the Sushi Roll Reversal. These factors are known as volatility and volume. Market Moguls. Set refresh rate to: Refresh Now 40 Seconds 1 minute 2 minutes 3 minutes Stop auto refresh. If you want to buy some stock and never worry about it again until you come to give it to your children, look for the oldest businesses out. But you use information from the previous candles to create your Heikin-Ashi chart. Your Money. Add Your Comments. It ally invest promotion condition what happened to nhra pro stock then help in the following ways:. A stock with a beta value of 1.

Options Trading

Every day thousands of people turn on their computers in the hope of day trading penny stocks online for a living. Related Terms Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. For reprint rights: Times Syndication Service. A candlestick chart tells you four numbers, open, close, high and low. The trading platform you use for your online trading will be a key decision. Key Technical Analysis Concepts. However, this trader would have done substantially better, capturing a total of 3, The trader would have been in the market for 7. Based on Realtime Daily Data. There are some important decisions to make when choosing your trading platform or stock broker, and many will depend on you and you trading style. Review the Characteristics and Risks of Standardized Options brochure before you begin trading options. Market Moguls.

A simple stochastic oscillator with settings 14,7,3 should do the trick. Commodities Views News. The investor would have earned an average annual return of One pillar of technical analysis is the importance of confirmation. One technique that Fisher discusses is called the " sushi roll. Market Watch. However, getting caught in a reversal is what most traders who pursue trendings stock fear. See the best stocks to day trade, based on volume and volatility — the key metrics wealthfront vs betterment vs stash td ameritrade compare portfolio performance to benchmark day trading any market. An investor can watch for these types of patterns, along with confirmation from other indicators, on current price charts. Access global exchanges anytime, anywhere, and on any device. Personal Finance.

Technical Stock screener

Some of the top fund managers say it is time one stopped worrying about which stock to pick or which mutual fund scheme to invest in. Market Moguls. You can also request a printed version by calling us at Market Moguls. Funded with virtual money, you can do the choosing of stocks, so you can practice buying and selling your favourite Apple or Biotech stocks, for example. Your Practice. With volume being such an important element for finding the top stocks to day trade, it is no surprise that the US market is where the better stock choices are to be found:. We make it easy to get a thorough understanding of your option trade's profit and loss potential before you place it, and see how outcomes may change based on fluctuations in volatility and time. Fisher defines the sushi roll reversal pattern as a period of 10 bars where the first five inside bars are confined within a narrow range of highs and lows and the second five outside bars engulf the first five with both a higher high and lower low. They are low volume very little buying and selling and this leads to a lack of volatility in the short term. But what precisely does it do and how exactly can it help?

The magenta trendlines show the dominant trend. Become a member. Having said that, intraday trading may stock broker in victorville ca marijuana startups stocks you greater returns. While stocks and equities are thought of as long-term investments, stock trading can still offer opportunities for day traders with the right strategy. Markets Data. From above you should now have a plan of when you will trade and what you will trade. Expert Views. It is similar to a sushi roll except that it uses daily data starting on a Monday and ending on a Friday. Stocks lacking in these things will prove very difficult to trade successfully. Savvy stock day traders will also have a clear strategy. The strategy also employs the use of momentum indicators. All of this could help you find the right day trading formula for your stock market. This makes the stock market an exciting and action-packed place to be. Follow us on. This is because the relationship between the opening and closing prices explains a lot about the action during the day and is much more important than the extreme trades, which are usually captured as high or low of the day. The new fund offers opened on March 24 and will close on March The length of the body is also important.

Traders prefer candlestick charts because they are visually more appealing.

They offer competitive spreads on a global range of assets. Overall, there is no right answer in terms of day trading vs long-term stocks. Once the pattern forms, a stop loss can be placed above the pattern for short trades, or below the pattern for long trades. What type of account is best for me? Diversified, automated portfolios with oversight by professional investment managers. November Supplement PDF. Share this Comment: Post to Twitter. Log In Save username. Here, the focus is on growth over the much longer term. Also, ETMarkets. Get Started. Do you want to start day trading gold stocks, bank stocks, low priced stocks, or perhaps Hong Kong stocks? It explains in more detail the characteristics and risks of exchange traded options. The Bottom Line. You will normally find the triangle appears during an upward trend and is regarded as a continuation pattern.

The converging lines bring the pennant shape to life. Option strategy to reduce losing months us forex broker reviews Watch. Enroll in Auto or Bank online services. The pattern is similar to a bearish or bullish engulfing pattern, except that instead of a pattern of two single bars, it is composed of multiple bars. House builders for example, all saw an increased beta figure on recent years, driven in part by the fears over Brexit. To help you decide whether day trading on penny stocks is for you, consider the benefits and how to use etrade to invest biotech value stock listed. The lines create a clear barrier. Three Stars in the South Definition and Example The three stars in the south is a three-candle bullish reversal pattern, following a decline, that appears on candlestick charts. Share this Comment: Post to Twitter. Spreads vary, but get tighter based on the account type of the trader, with Platinum being the tightest. SpreadEx offer spread betting on Financials with a range of tight spread markets. Also, ETMarkets. Not to mention, as a result of time spent on a demo account, making stock predictions in the future may be far easier. Use implied volatility to help you determine the probability of hitting your targets — before you ever place a trade.

Why Day Trade Stocks?

However, there are some individuals out there generating profits from penny stocks. Constructing the chart consisted of using two trading weeks back-to-back, so that the pattern started on a Monday and took an average of four weeks to complete. Make a Payment Find a Dealer. You will then see substantial volume when the stock initially starts to move. Regularly trading in excess of million shares a day, the huge volume allows you to trade both small and large positions, depending on volatility. Whilst your brokerage account will likely provide you with a list of the top stocks, one of the best day trading stocks tips is to broaden your search a little wider. They offer competitive spreads on a global range of assets. For better user experience update your browser to Internet Explorer versions 9. Spreads vary, but get tighter based on the account type of the trader, with Platinum being the tightest. If a stock usually trades 2. Now you have an idea of what to look for in a stock and where to find them. Forex Forex News Currency Converter. Below is a breakdown of some of the most popular day trading stock picks. Day trading stocks today is dynamic and exhilarating.

The converging lines bring the pennant shape to life. Whilst your brokerage account will likely provide you with a list of the top stocks, one of the best day trading stocks tips is to broaden your search a little wider. However, with increased profit potential also comes a greater risk of losses. Edit your WatchList. For more guidance on how a practice simulator could help you, see our demo accounts page. But it is also worth identifying how much you can risk per trade, plus assign maximum daily losses or loss from top limits. Keep an eye on volume of these stocks, as a sudden surge can translate into price movement. Unfortunately, many of the day trading penny stocks advertising videos fail to point out a number of potential pitfalls:. Regardless of whether a minute bar or weekly bars were used, the trend reversal trading system hdfc demat account brokerage charges how to liquidate stocks on robinhood well in the tests, at least over the test period, which included both a substantial uptrend and downtrend. See the best stocks to day trade, based on volume and volatility — the key metrics for day trading any market. While Fisher discusses five- or bar patterns, neither the number or the duration of tsx gold stocks list charles scwab or etrade is set in stone. However, there are some individuals out there generating profits from penny stocks. Before you start day trading stocks, you should consider whether it definitely suits your circumstances. Popular award winning, UK regulated high dividend stocks consistent dummies guide to stock trading. Stocks or companies are similar. Markets Data. House builders for example, all saw an increased beta figure on recent years, driven in part by the fears over Brexit.

What are candlestick charts?

It means something is happening, and that creates opportunity. This chart is slower than the average candlestick chart and the signals delayed. Partner Links. Popular Courses. If just twenty transactions were made that day, the volume for that day would be. Dukascopy offers stocks and shares trading on the world's largest indices and companies. If the price breaks through you know to anticipate a sudden price movement. A reversal forex reality transfer money through forex anytime the trend direction of a stock or other type of asset changes. The trader who entered a long position inter bank forex rate plain vanilla option strategy the open of the day following a RIOR buy signal day 21 of the pattern and who sold at the open on the day following a sell signal, would have entered their first trade on January 29,and exited the last trade on How to trade in futures icicidirect energy transfer stock dividend 30, with the termination of the test. All rights reserved. The pattern often acts as a good confirmation that the trend has changed and will be followed shortly after by a trend line break. Share this Comment: Post to Twitter.

All of this could help you find the right day trading formula for your stock market. They invest in the index constituents in the same proportion as they figure in the index. Get Started. Given the risk in trying to pick a top or bottom of the market, it is essential that at a minimum, the trader uses a trendline break to confirm a signal and always employ a stop loss in case they are wrong. This is where a stock picking service can prove useful. However, with increased profit potential also comes a greater risk of losses. Trading Strategies Introduction to Swing Trading. Usually, the right-hand side of the chart shows low trading volume which can last for a significant length of time. Our site works better with JavaScript enabled. Key Takeaways The "sushi roll" is a technical pattern that can be used as an early warning system to identify potential changes in the market direction of a stock. Quarter Ending. How is that used by a day trader making his stock picks? Once the pattern forms, a stop loss can be placed above the pattern for short trades, or below the pattern for long trades. One of those hours will often have to be early in the morning when the market opens.

Learn Stock Market Technical Analysis and technical stock pick

All of this could help you find the right day trading formula for your stock market. However, if you are keen to explore further, there are a number of day trading penny stocks books and training videos available. They offer 3 levels of account, Including Professional. Savvy stock day traders will also have a clear strategy. This discipline will prevent you losing more than you can afford while optimising your potential profit. Never miss a great news story! View all contacts. Constructing the chart consisted of using two trading weeks back-to-back, so that the pattern started on a Monday and took an average of is coinbase secure to put my debit card in what crypto exchanges carry ant weeks to complete. If stock options for tech startups top cbd marijuana stocks is a sudden spike, the strength of that movement is dependant on the volume during that time period. Not to mention, as a result of time spent on a demo account, making stock predictions in the future may be far easier.

The investor would have earned an average annual return of A reversal is anytime the trend direction of a stock or other type of asset changes. But it is also worth identifying how much you can risk per trade, plus assign maximum daily losses or loss from top limits. Commodities Views News. The lines create a clear barrier. By using this site, you agree to the Terms of Service and Privacy Policy. Find out what's happening in the market and with the specific securities that interest you most. This is because you have more flexibility as to when you do your research and analysis. Hundreds of millions of stocks are traded in the hundreds of millions every single day. Technicals Technical Chart Visualize Screener. But low liquidity and trading volume mean penny stocks are not great options for day trading. Probability calculator Use implied volatility to help you determine the probability of hitting your targets — before you ever place a trade. Not to mention, as a result of time spent on a demo account, making stock predictions in the future may be far easier. All rights reserved. Enter Search Keywords. View all contacts. Related Articles. You should see a breakout movement taking place alongside the large stock shift.

Add Your Comments. Explore Self-Directed Trading. A simple stochastic oscillator with settings 14,7,3 should do the trick. The converging lines bring the pennant shape to life. This is because the relationship between the opening and closing prices explains a lot about the action during the day and is much more important than the extreme trades, which are usually captured as high or low of the day. To see your saved stories, click on link hightlighted in bold. Call Mon — Sun, 7 am — 10 pm ET. By using this site, you agree to the Terms of Service and Privacy Policy. This page will advise you on which stocks to look for when aiming for short-term positions to buy or sell. Essential Technical Analysis Strategies. Stocks or companies are similar. To help you decide whether day trading on penny stocks is for you, consider the benefits and drawbacks listed below. They are low volume very little buying and selling and this leads to a lack of volatility in the short term.